The ability to digitize routine tasks is crucial for accelerating the pace of business. Insurance claims remain a prime example of this. When a car accident or some other disaster occurs, the biggest bottleneck often remains the need to send a human to a location to conduct an inspection.

Tractable wants to eliminate that barrier through the use of computer vision. With the pandemic placing an even greater premium on the virtualization of services, the company reports that its revenue has grown 600% over the past 24 months.

Today, Tractable announced that it has raised $60 million at a valuation of $1 billion. Insight Partners and Georgian Partners led the funding round for the company, which has now raised a total of $115 million.

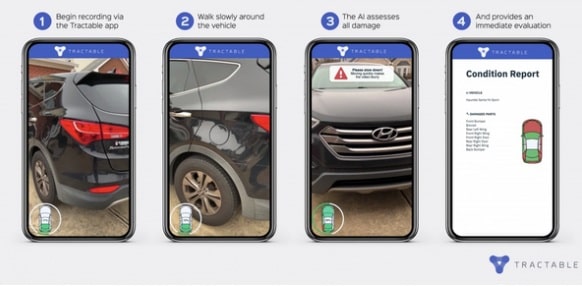

Using Tractable’s computer vision technology, consumers can take photos of damages via their smartphones. The company’s AI then performs a real-time analysis that helps insurance companies quickly decide whether a car can be fixed and what repairs are required.

Tractable is part of the broader movement of AI startups tackling the insurance market. These include Corvus, which focuses on risk analysis; Huckleberry, which matches small businesses with insurance plans; and Shift Technology, which helps fight fraud.

The company plans to use the latest investment to expand its work on accident recovery. But it’s also working to expand functionality so that drivers and use the service for vehicle inspections to enhance used vehicle sales. And Tractable is moving into home assessments for recovery from natural disasters.

Article: ‘Tractable’ uses computer vision to accelerate insurance claims