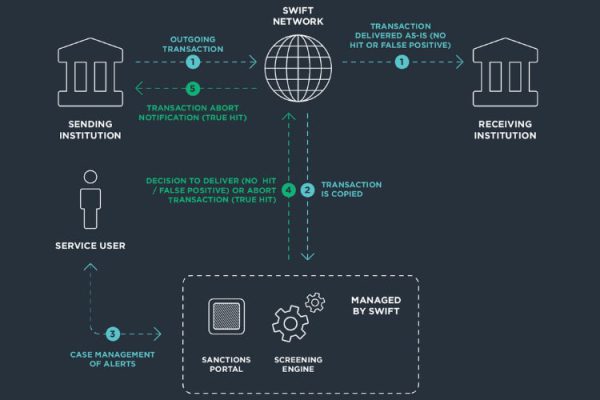

LONDON, March 25 (Reuters) – Global bank messaging network SWIFT is planning a new platform in the next one to two years to connect the wave of central bank digital currencies now in development to the existing finance system, it has told Reuters.

The move, which would be one of the most significant yet for the nascent CBDC ecosystem given SWIFT’s key role in global banking, is likely to be fine-tuned to when the first major ones are launched.

Around 90% of the world’s central banks are now exploring digital versions of their currencies. Most don’t want to be left behind by bitcoin and other cryptocurrencies, but are grappling with technological complexities.

SWIFT’s head of innovation, Nick Kerigan, said its latest trial, which took 6 months and involved a 38-member group of central banks, commercial banks and settlement platforms, had been one of the largest global collaborations on CBDCs and “tokenised” assets to date.

It focused on ensuring different countries’ CBDCs can all be used together even if built on different underlying technologies, or “protocols”, thereby reducing payment system fragmentation risks.

It also showed they could be used in highly complex trade or foreign exchange payments and potentially be automated so to both speed up and lower the costs of the processes.

Kerigan said the results, which had also proven banks could use their existing infrastructure, had been widely regarded as a success by those who took part and given SWIFT a timeline to work to.

Article: SWIFT planning launch of new central bank digital currency platform in 12-24 months