A new report by the Bank for International Settlements (BIS) shows that buy now, pay later (BNPL) adoption among young adults, particularly those with low education, is soaring. This trend is becoming increasingly prevalent in countries experiencing high inflation and where households tend to have higher debt levels.

BNPL allows consumers to spend money they don’t have over a number of interest-free installments, which are generally unreported to credit bureaus. The overuse and poor understanding of BNPL terms can be disastrous for consumers and lead to overindebtedness.

A surge in BNPL use was seen during Black Friday and Cyber Monday. According to Adobe Analytics, BNPL use on Cyber Monday hit a record high, up 43% from a year ago.

While the White House celebrated record holiday sales, a closer look at the data revealed a concerning trend: an increasing number of consumers are resorting to BNPL services for big-ticket items and essential goods, such as groceries. The reliance on BNPL indicates debts could be stacking up on consumers, which could strain service debts immensely.

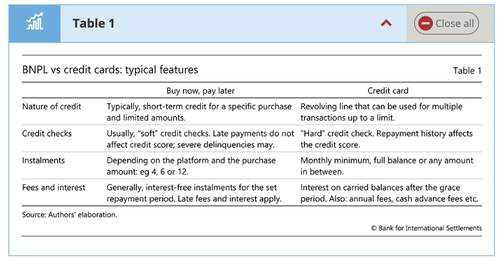

BIS provided a simple breakdown of how BNPL services differ from credit cards.

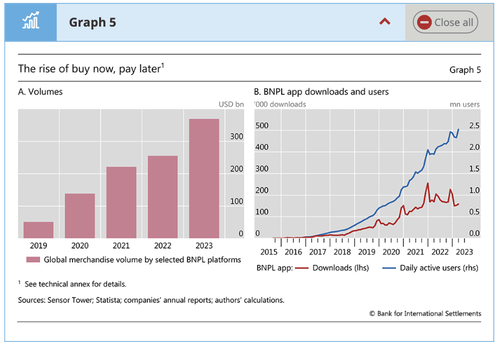

The volume of global BNPL transactions and daily active users of BNPL services continues to skyrocket.

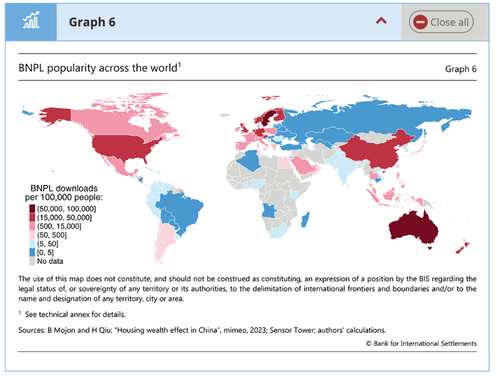

BNPL is the most popular in Australia, then across the West and China:

The popularity of BNPL varies widely around the globe (Graph 6). The countries with the highest adoption rates are Australia and Sweden. Other countries with significant BNPL uptake are China, Finland, Germany, the Netherlands, New Zealand, Norway, Singapore, the United Kingdom and the United States.

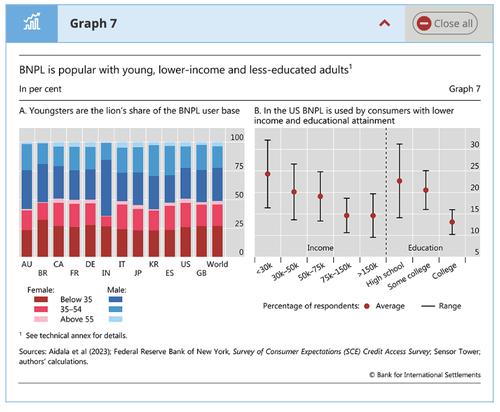

BIS finds the average BNPL user is under 35, has a low income, and lacks education:

Younger and tech-savvy individuals, including “Millennials” and “Generation Z,” often do not possess credit cards (PYMTS (2023)) and are generally less financially literate than older generations (Lusardi and Mitchell (2023)). Consistent with this, a survey of US BNPL services reveals that they are more often used by individuals with low-income levels and less educational attainment.

“There is evidence from the United States that BNPL users are particularly risky,” BIS said.

BNPL-fueled record holiday sales are nothing to cheer about as it only shows working poor consumers are adding even more leverage and insurmountable debts as Bidenomics fails.

Article: “Particularly risky” – BIS reveals “buy now, pay later” use is soaring among working poor youngsters