The Consumer Financial Protection Bureau (CFPB) warned mortgage firms Thursday “to take all necessary steps now to prevent a wave of avoidable foreclosures this fall.”

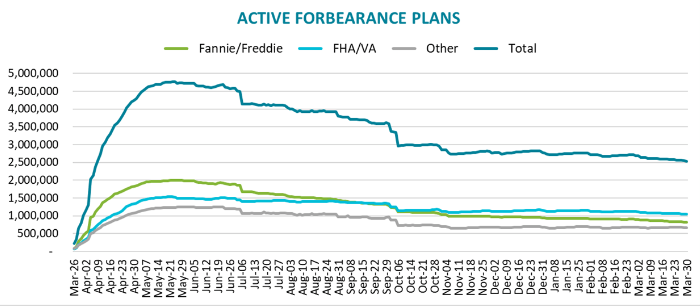

As of March 30, approximately 2.54 million homeowners remain in forbearance or about 4.8% of all mortgages, according to the latest data from Black Knight’s McDash Flash Forbearance Tracker.

CFPB said mortgage firms should “dedicate sufficient resources and staff now to ensure they are prepared for a surge in borrowers needing help.” To avoid what the agency called “avoidable foreclosures” when the forbearance relief lapses, mortgage servicers should begin contacting affected homeowners now to guide them on ways they can modify their loans.

“There is a tidal wave of distressed homeowners who will need help from their mortgage servicers in the coming months,” said CFPB Acting Director Dave Uejio. He said,

“There is no time to waste and no excuse for inaction. No one should be surprised by what is coming.”

The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided a safety net for borrowers with federally-backed mortgages who could access forbearance programs. With millions of borrowers in the program set to lapse in the second half of the year, unavoidable foreclosure will occur despite the government trying everything under the sun to keep people in their homes.

“Our first priority is ensuring struggling families get the assistance they need. Servicers who put struggling families first have nothing to fear from our oversight, but we will hold accountable those who cause harm to homeowners and families,” Uejio said.

With the CFPB focused on preventing avoidable foreclosures, the government’s forbearance programs ends in September, which could result in the quick unraveling of the social fabric for many households who may find themselves homeless.

Article: Feds warn mortgage firms: “Tidal wave of distress” coming as forbearance programs set to lapse