Another day, another restaurant doomsday story.

According to the latest Alignable Rent Poll, it’s becoming increasingly difficult for small businesses everywhere to pay their rent in full and on time, given the latest COVID resurgences. The need for more federal funding is also becoming more pronounced for many of these businesses, according to the poll.

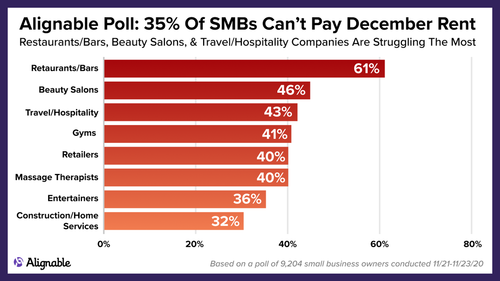

These findings are based on the most recent Alignable Rent Poll conducted among 9,204 small business owners from 11/21-11/23/2020.

Here are the highlights:

- Several B2C industries are devastated – 61% of restaurants can’t pay their rent this month. That’s up 19% from 42% in November.

- 35% of U.S. small businesses couldn’t pay their rent this month, up 3% from 32% in November.

- Beauty salons (46%) and travel/hospitality businesses (43%) round out the Top 3 most-affected businesses, but many others are in trouble.

- Looking at demographics, minority-owned businesses are suffering the most, as 49% of them reported that they could not afford their rent in December. That figure is 5% higher than it was in November.

- Women-owned businesses are also struggling (38% of those have not paid their rent, up 3% from 35% last month).

Overall, 35% of small business owners reported that they couldn’t make rent this month (up 3% from 32% in November). For minority-owned businesses, the struggle is even more pronounced: nearly half (49%) report being unable to cover their rent in December. That figure jumped 5% from 44% in November. For women-owned businesses, 35% couldn’t make rent in November and now that percentage is up to 38% in December.

Looking at different sectors, it’s clear that money is growing even tighter in many B2C industries, and paying rent is becoming increasingly more challenging.

Restaurants/bars top the list in December with 61% unable to cover their rent. (And that’s up 19% since November).

Nearly half of beauty salons (46%) had trouble paying the rent, as did 43% of travel/hospitality businesses.

High percentages of small business owners in other industries also couldn’t pay their rent in full, on time:

- 41% of gyms

- 40% of retailers

- 40% of massage therapists

- 36% of entertainers

- 32% of construction/home services firms.

Most noted that increasing restrictions based on COVID resurgences are causing more problems for them — and limiting the kind of revenue they can make for the rest of the year, and perhaps, beyond.

Rent Woes Across The U.S. & Canada

While 35% of U.S.-based small businesses are unable to pay December rent, small businesses in a variety of states are even more cash-strapped.

In Canada, the rate is even higher – 37% of Canadian small business owners said they couldn’t make December rent, 1% higher than in November. Here’s the breakdown by state for those matching or exceeding the overall, national U.S. average:

- NY — 43%

- AZ — 43%

- IL — 42%

- OR — 42%

- WA — 40%

- MD — 40%

- NJ — 39%

- PA — 39%

- CA — 37%

- VA — 36%

- GA — 36%

- MN — 36%

- FL — 35%

- SC — 35%

The following states are still struggling, but not as much as those listed above:

- TX — 34%

- MI — 34%

- OH — 32%

- MA — 31%

- CO — 29%

- NC — 27%

- MO — 20%

Shifting from the U.S. to Canada, the survey witnessed a range of rent payment rates across the provinces. On one extreme, small businesses in British Columbia appear to be weathering the COVID storm a bit better, with only 30% of them reporting that they couldn’t afford to pay rent in full and on time. However, the situation is more severe in other parts of Canada: 43% of small businesses in Alberta, and 42% in Ontario reported not making December rent.